In a world where we’re seeing headlines of tenants not paying rent, malicious damage and even refusing to leave the property – how can you cover yourself in case things turn sour? Landlord insurance is designed to protect you as the property owner from financial losses connected to the rental such as theft, fire, or weather damage and can be extended to include coverage for things like unpaid rent and damage by tenants.

Technically, no. You are under no legal obligation to obtain landlord insurance. However, some lenders make it a requirement when taking out a buy to let mortgage.

If you don’t want to put your financial future at risk, then yes. And in some cases, your tenancy agreement may require certain responsibilities of you that best served by an insurance agreement. Basically, having it screams “I am a trustworthy landlord!”

We’ve put together a few easy-to-digest infographics for you to gain some insight on Landlord insurance and how it will benefit you.

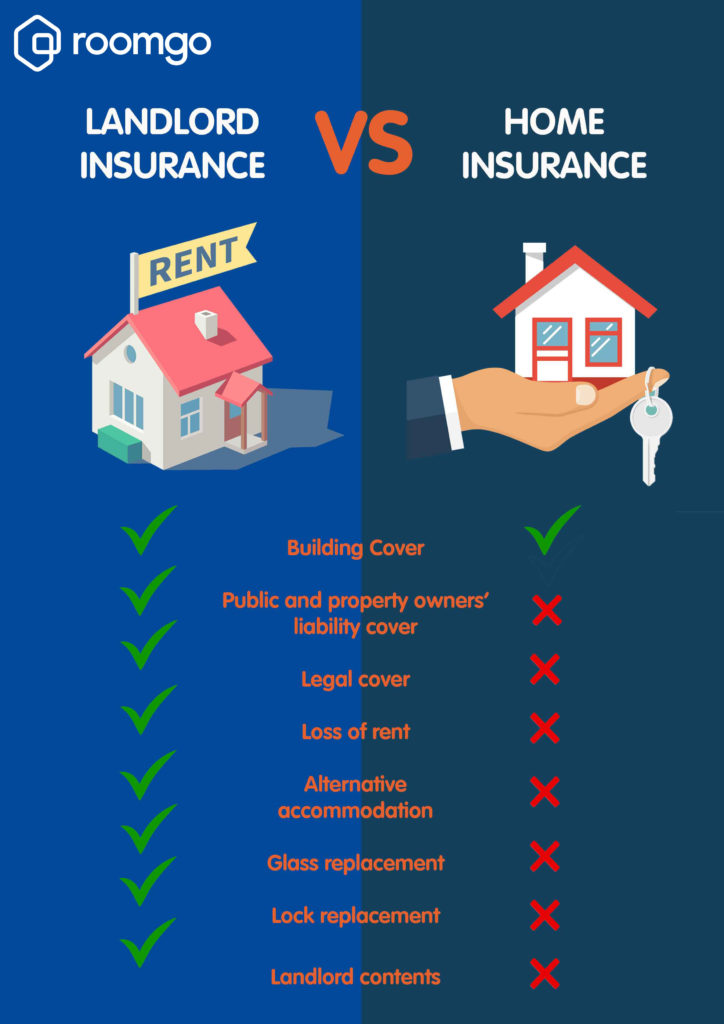

Difference between landlord insurance and home insurance

Read also

>>> Pros and cons of renting your property to students

>>> Landlords: How do you carry out a proper reference check?

>>> Renting the Whole Property vs. Renting the Rooms Separately

Types of tenant

What does landlord insurance typically cover?

Optional cover for landlord’s insurance

Extra tips for landlords

There are a few other things you can do to make sure you’re covered:

1. Tenant referencing

A tenant reference is a wise way for landlords to vet their tenants to confirm their financial status and references. It’s always best to check these things before you start signing any agreements. You can see how to carry out a proper reference check using our guide here

To go further:

>>> How to rent: a guide to Renting out a Room

>>> How to give a good flat viewing: the landlord’s checklist

>>> Renting and subletting : pros and cons

>>> Tenancy deposit: what deductions can you make as a landlord?

2. Rent guarantee

Not to be confused with ‘loss of rent’ as mentioned above.Rent guarantees are offered by agencies to cover you in case a tenant can’t make the rent for whatever reason. This type of cover isn’t included in landlord insurance packages.

3. Renting to DSS

To avoid any potential financial disagreements when renting to DSS,it’s worth putting a few steps in place to cover your back:

- Check their payment method for making rental payments (cash, card, bank transfer etc)

- Ask how much rent will be covered by the financial support they receive.

- Check their rental history.

- Be flexible with when they pay their rent – It may work out better for them to make weekly payments rather than monthly.

- Declare the tenant to the local council so all bills are made to them.

If you have a property and are looking for tenants, there’s no better place to find someone than on Roomgo. We currently have over 20,000 tenants looking for a room in the UK.